If you only have a Last Will and Testament in the State of Florida, you WILL have to go through the probate process.

The probate process is a court-supervised legal procedure that validates the will, settles any outstanding debts and taxes of the deceased person (referred to as the “decedent”), and distributes the assets to the beneficiaries according to the terms of the will. The purpose of probate is to ensure that the decedent’s wishes are carried out, debts are paid, and assets are properly transferred to the intended beneficiaries.

Here are some key points to understand about the probate process in Florida:

1. Validation of the Will: The will is submitted to the probate court for validation. The court reviews the will to ensure that it is legally valid, properly executed, and meets the requirements of Florida law.

2. Appointment of Personal Representative: If the will names an executor (also known as a personal representative), the court will officially appoint that person to oversee the administration of the estate. If there is no named executor or if the named executor is unable or unwilling to serve, the court will appoint a personal representative.

3. Notice to Creditors and Beneficiaries: During probate, notice is given to potential creditors of the decedent to allow them to file claims against the estate. Additionally, beneficiaries and heirs are notified of the probate proceedings.

4. Debts and Taxes: The personal representative is responsible for identifying and paying the decedent’s debts and taxes using the assets of the estate. This may involve selling assets to cover these expenses.

5. Distribution of Assets: Once debts, taxes, and administrative expenses are paid, the remaining assets are distributed to the beneficiaries according to the terms of the will. If there is no will (intestacy), Florida’s laws of intestacy will dictate how assets are distributed.

6. Probate Court Oversight: The probate court supervises the entire process to ensure that it is carried out according to Florida law.

It is important to note that the probate process can take time, typically ranging from several months to more than a year, depending on the complexity of the estate, any disputes, and other factors. Additionally, probate proceedings are a matter of public record, which means that the details of the estate and the will become accessible to the public.

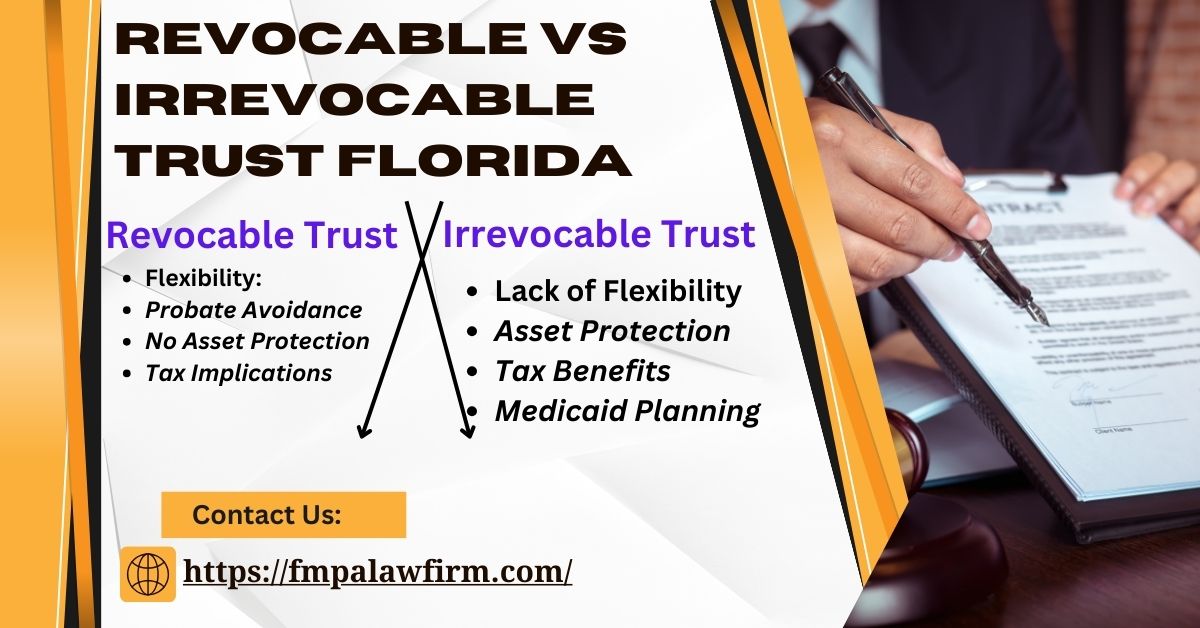

For individuals who wish to avoid the probate process or ensure more privacy in the distribution of their assets, using a revocable living trust as part of their estate plan can be an alternative. Assets held in a revocable living trust generally avoid probate.

Consulting with an experienced estate planning attorney in Florida can help you understand your options and make informed decisions based on your circumstances and goals. Contact Martha Mendez today by calling 786-636-8938 or by email: [email protected] to discuss your options with respect to the probate process.